Home Mortgage: Tips To Maintain You Safe

Article by-Schneider Borregaard

When searching out that mortgage that you've been wanting, you have to know the criteria for evaluating mortgages. The mortgage industry is a vast field, and without the proper tools and knowledge, you're going to find yourself lost. So, get going with this article, and find yourself making the right decisions.

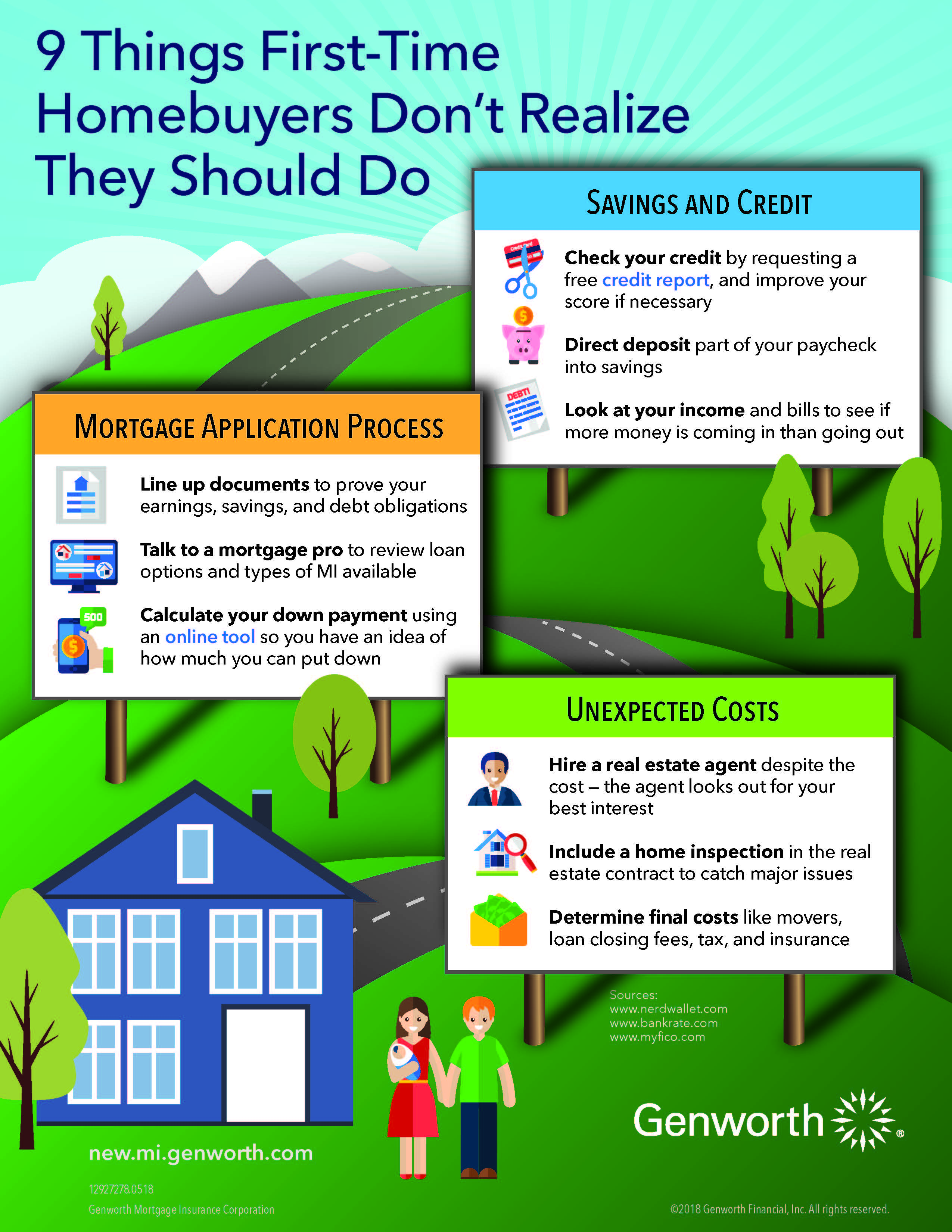

Check your credit report before applying for a mortgage. With today's identity theft problems, there is a slight chance that your identity may have been compromised. By pulling a credit report, you can ensure that all of the information is correct. If you notice items on the credit report that are incorrect, seek assistance from a credit bureau.

If your mortgage has been approved, avoid any moves that may change your credit rating. Your lender may run a second credit check before the closing and any suspicious activity may affect your interest rate. Don't close credit card accounts or take out any additional loans. Pay every bill on time.

Make sure you're organized when you apply for a mortgage and have thought through the required terms. This will require setting realistic boundaries about your affordable monthly payments based on budget and not dreams of what house you get. No matter how great a new home is, if it leaves you strapped, trouble is bound to ensue.

Get a consultant to help you with the home loan process. There are lots of things involved with the process and a consultant will be able to get you a great deal. They can assist you in securing fair terms, and help you negotiate with your chosen company.

Save your money. When you are going to finance a home mortgage, you will need to have some cash for a down payment. The more money you pay down, the lower your payments and interest rates. The down payment goes directly to the principal of the mortgage and is a sum you will not owe yearly interest on.

When you decide to apply for a mortgage, make sure you shop around. Before deciding on the best option for you, get estimates from three different mortgage brokers and banks. Although, interest rates are important, there are other things you should consider also such as closing costs, points and types of loans.

Know that Good Faith estimates are not binding. These estimates are designed to give you a good idea of what your mortgage will cost. It should include title insurance, points, and appraisal fees. Although you can use this information to figure out a budget, lenders are not required to give you a mortgage based on that estimate.

Before you get a loan, pay down your debts. You have to be able to have enough money to pay your mortgage month after month, regardless of the circumstances. You will make it much easier if you have minimal debt.

Once you have secured financing for your home, you should pay a bit above the interest every month. This practice allows you to pay off the loan at a much quicker rate. Paying only 100 dollars more per month on your loan can actually reduce how long you need to pay off the loan by 10 years.

Get help if you're struggling with your mortgage. There are a lot of credit counselors out there. Make sure you pick a reputable one. HUD offers mortgage counseling to consumers in every part of the country. These counselors can help you avoid foreclosure. Call HUD or look online for their office locations.

Shop around for a mortgage broker that is a good fit for you. Remember that you are about to embark on a decades-long relationship with this lender, so you want to feel entirely comfortable dealing with the company. Do some online research, read reviews, look for lenders with excellent BBB ratings. Once you have sorted out a few, call and/or visit their offices. Apply with them and see if you can get a letter of pre-approval from the lender you eventually settle on.

Research the lender you like. Mortgage lenders are usually covered by regulations via their own state. Look at the rules concerning lenders in that state. This will give you a better feel for their governing licenses and liabilities. Do a check of their reputation with the Better Business Bureau as well.

If you are a retired person in the process of getting a mortgage, get a 30 year fixed loan if possible. Even though your home may never be paid off in your lifetime, your payments will be lower. Since you will be living on a fixed income, it is important that your payments stay as low as possible and do not change.

Ask around about mortgage financing. You may be surprised at the leads you can generate by simply talking to people. Ask your co-workers, friends, and family about their mortgage companies and experiences. They will often lead you to resources that you would not have been able to find on your own.

Opt out of credit offers before applying for a home mortgage. Many times creditors will pull a credit file without your knowledge. This can result in an immediate decline for a home mortgage. To help prevent this from happening to you, opt out of all credit offers at least six months before applying for a loan.

If your mortgage lender will give you a letter of approval, it may open some doors with sellers. This type of letter speaks well of your financial standing. However, make sure that the approval letter is for the amount of your offer. If it shows a higher amount, then the seller will see this and realize you could pay more.

When shopping for a mortgage loan, ask if the rate is adjustable or fixed. https://www.prnewswire.com/news-releases/td-bank-tops-small-business-banking-in-the-south-according-to-jd-power-301459527.html have interest rates which can vary greatly during the life of the mortgage. Also, https://www.ft.com/content/ef996142-e5dd-45ae-9008-fc4cbd8c291d will never be fixed and can increase by hundreds of dollars monthly. If the rate on the loan is adjustable, ask how and when the loan payment and rate could change.

During the process of obtaining a mortgage loan, submit any requested documents to your mortgage broker or lender as soon as possible. Taking your time to respond to your lender can delay the date of the closing. Delaying the closing date can put you at risk of losing the rate you have locked-in.

After reading this beneficial advice, you are on your way to getting a good mortgage. Utilize what you know, and start confidently searching for the mortgage that best fits your needs. When you have found the one, you will know. It feels good to have a good mortgage company on your side.